Can You Finance a Steel Building, or Do You Need to Pay Upfront?

Thinking about investing in a steel building? You’re not alone. Deciding whether to finance or pay upfront can influence your project’s direction and your budget, impacting how you handle investments and manage money. Look into the expenses, starting with the buying price and including ongoing factors like thorough financial review and managing cash flow. Look at different methods to pay for your project and weigh the pros and cons of each. Think about different payment methods and sources for getting money to build. Your choice could affect everything, so let’s examine the options to find the best way forward for you.

Overview of Steel Buildings

Steel structures, typically pre-made, are built with steel frames that offer great strength relative to their weight, making them suitable for various uses, like obtaining funds through investor financing and equity financing in business projects.

These structures, often referred to as metal buildings or steel structures, are commonly used for commercial spaces, warehouses, and industrial facilities due to their durability and design flexibility.

Their popularity has surged, largely because they are both cost-effective and quick to assemble compared to traditional construction methods, offering strategic advantages in economic considerations and project timeline management. For instance, a typical steel warehouse can be erected in a fraction of the time required for a concrete building, translating to faster occupancy and revenue generation.

Many businesses use modern software for organizing and creating, which improves productivity and personalization, enhancing operational costs efficiency and lending to better budget planning.

Importance of Financing Options

Looking into financing choices is important because getting the right funds, such as developer loans or business loans, can greatly affect your budget and project schedule.

Knowing interest rates and loan conditions is important when dealing with financing, as they can impact your loan terms and repayment schedule. For instance, a fixed-rate mortgage offers stability with consistent monthly payments, while an adjustable-rate mortgage might start with lower rates but can fluctuate significantly over time.

Consider the loan term; a 15-year loan may have higher monthly payments but will save on interest compared to a 30-year term.

Tools like Bankrate or NerdWallet can guide you in reviewing these options clearly, helping with loan applications and getting pre-approval for your project budget.

Understanding Steel Building Costs

The total expense of steel buildings includes many factors besides just the purchase price, affecting how you plan your investment, including project feasibility and ownership structure.

Initial Purchase Price

The initial purchase price of a steel building ranges from $10 to $20 per square foot, depending on the specifications and local market conditions.

Different elements influence this cost, including hard costs, soft costs, and the economic viability of the project. For instance, a simple 30×40 foot building may cost around $12,000, while a more complex 60×100 foot structure could reach $50,000 or more.

Design details like insulation and special features can increase costs by about $2 to $5 per square foot, factoring into the overall construction budget analysis. Location impacts pricing due to regional material costs and shipping fees, and can also influence building permits and zoning regulations compliance.

So, it’s important to look at your exact needs and talk to local suppliers to get quotes that match your project, considering potential tax credits and investment returns.

Additional Costs

Besides the buying price, there are extra expenses like preparing the site, permits, and connecting utilities. These can cost between $5,000 and $15,000, and are key for a correct estimate of the project’s total cost.

Site preparation typically costs between $1 to $3 per square foot, depending on the land’s condition. For example, clearing a 1,500-square-foot area might cost around $2,500.

Building permits can cost different amounts. In some places, they might be as low as $200. In other locations, they can be more than $2,000. The cost depends on local building rules and construction plans.

Utility connections often add another $1,000 to $5,000, especially where water and electricity aren’t readily available, impacting the construction budget.

Prospective buyers should budget for these variable expenses to avoid surprises during construction, ensuring they have enough contingency funds.

Long-term Investment Considerations

When investing in steel buildings, think about long-term factors such as resale value, maintenance costs, potential property appreciation, and thorough risk assessment.

Steel buildings typically depreciate at a rate of about 2% annually over ten years, meaning their resale value can significantly decline if not maintained properly. In contrast, properties in high-demand areas often appreciate, sometimes by 3% to 5% per year.

To get the most from your investment, regularly maintain and update items like insulation and appearance to increase resale value, and perform regular property checks. Thorough market research can also help identify locations with a high potential for appreciation, ensuring a well-rounded investment strategy.

Financing Options for Steel Buildings

Learning about the different ways to pay for steel buildings can help you choose options that fit your budget.

Traditional Bank Loans

Traditional bank loans, a common form of commercial financing, usually have fixed interest rates between 4% and 6% for periods of 15 to 30 years, providing a reliable option for financing.

This stability allows borrowers to budget effectively, knowing their monthly payments will remain constant throughout the loan term, which is beneficial for financial forecasts.

Securing a traditional loan can be challenging; lenders often require good credit scores, consistent employment, and thorough documentation of income, including project financing details.

The approval process may take weeks, which can be a drawback for those needing quick access to funds. Despite this, the benefits like lower interest rates and predictable repayment schedules often make up for the initial challenges, especially for long-term investments such as buying a home.

Credit Unions

Credit unions often provide competitive rates, sometimes lower than banks, with a focus on community and member service, potentially offering more favorable financing structure.

Their customized service can significantly help borrowers, facilitating easier access to funding options. For example, the Navy Federal Credit Union provides construction loans at rates beginning around 5.5%. The Local Government Federal Credit Union offers special financing choices without hidden fees.

Members benefit from lower origination costs and more flexible terms, typically seeing rates that are 1-2% lower than national bank averages. Talking directly with a credit union loan officer can help you learn about local programs or grants, improving your choices for construction financing.

Private Lenders

Private lenders can offer flexible financing options with quicker approval times, typically charging higher interest rates from 7% to 12%, often requiring collateral.

While the ability to secure funding quickly is a significant advantage, there are some pros and cons to consider.

A good thing is that lenders usually have more relaxed credit rules, allowing people with bad credit records to qualify more easily, which can be a critical factor in loan eligibility. The trade-off typically includes higher overall costs, including origination fees and heavy interest charges.

Borrowers should closely review all terms and, if possible, compare offers from various private lenders to get the best deal, while considering how it will affect their debt-to-income ratio.

Manufacturer Financing Programs

Several steel building manufacturers offer specific loan choices for their products, simplifying the process of obtaining financing via their construction loan plans.

These programs often feature lower initial payments, allowing customers to invest in quality steel structures without overwhelming upfront costs, which can be attractive for asset financing.

For instance, manufacturers like Morton Buildings and General Steel provide direct relationships with financial institutions to facilitate seamless transactions. By offering competitive interest rates and flexible terms, customers can choose options that align with their financial situation.

These programs help customers feel confident by ensuring direct contact with the supplier, simplifying communication and service during purchases, and lowering contractor costs.

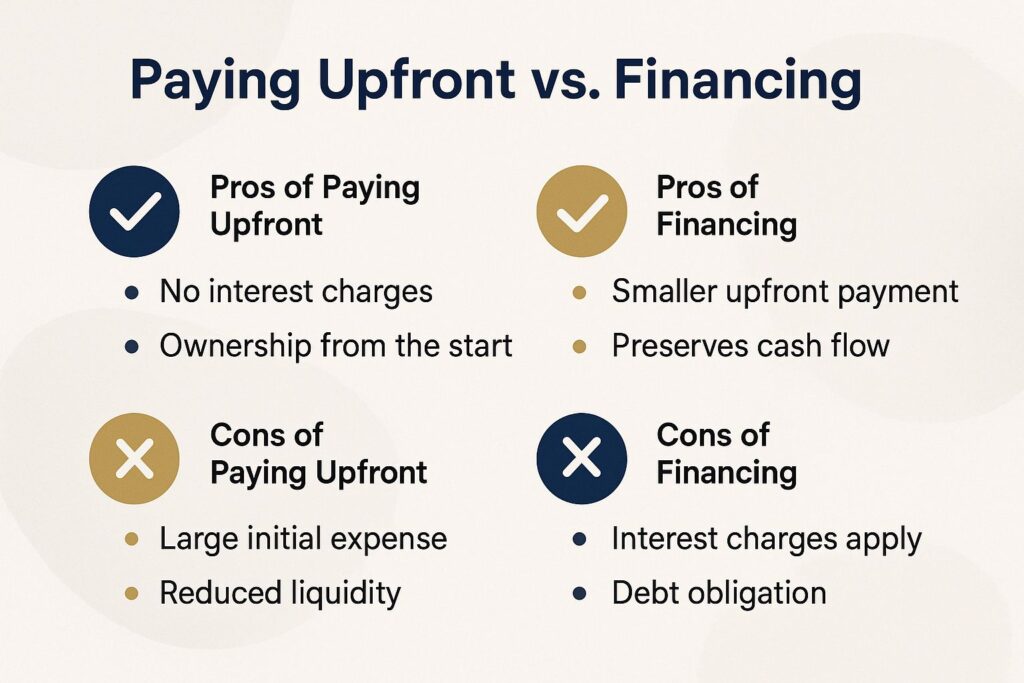

Paying Upfront vs. Financing

Deciding between paying upfront or using financing for a steel building can significantly impact your budget and project management, including the project’s running costs.

Pros of Paying Upfront

Paying in advance can save you money over time, as it removes interest payments and often qualifies you for discounts of 5% or more, helping you manage your cash reserves better.

For example, when purchasing equipment for a business, paying a $10,000 invoice immediately could save you $500 if the supplier offers a discount for upfront payments.

By avoiding financing, you skip interest costs that could reach $1,200 over a year with an average 12% annual rate, enhancing your project’s cash payment strategy.

By closely examining payment terms, you can save money and redirect those savings to important parts of your business like marketing or development, which can improve your financial situation.

Cons of Paying Upfront

Paying upfront can strain your liquidity, leaving less cash available for unforeseen expenses or opportunities, impacting your project’s construction insurance and financial documentation.

For instance, if you invest $10,000 into equipment, that money is tied up, potentially preventing you from seizing a time-sensitive investment like a discount on bulk inventory. This could limit your operational flexibility and hinder growth.

A better approach might be to consider financing options, such as a low-interest loan or leasing options, which spreads payments over time. This way, you maintain a healthy cash flow and can allocate funds to other essential areas like marketing or emergency reserves.

Reviewing cash flow helps find the best ways to handle payments and predict upcoming cash requirements, ensuring alignment with your business plan.

Pros of Financing

Financing allows for better cash flow management, enabling you to allocate funds to other critical areas of your project, aligning with your project’s construction budget and economic viability.

By spreading out payments, you retain liquidity that can be invested elsewhere, enhancing your project’s growth potential.

For instance, if you finance a $50,000 piece of equipment with a loan at 7% interest over five years, you can keep your working capital available for hiring talent or marketing efforts, maximizing potential investment return.

Earning money from rentals or extra work can help pay these bills without putting pressure on your main income, letting you keep investing in new opportunities, effectively managing your financial management and risk assessment.

Cons of Financing

On the downside, financing incurs additional costs through interest payments, which can significantly increase your total expenditure, affecting your project’s financial forecasts and repayment terms.

For example, if you finance a $1,000 purchase with an interest rate of 15% over three years, you might end up paying over $1,500 in total. This shows the main amount and the total interest charges.

In contrast, paying cash upfront doesn’t bear these extra charges, allowing you to save money in the long run. Financing can lead to debt accumulation, particularly if multiple financed purchases are made, creating a cycle of repayment and potential financial strain.

Factors Influencing Your Decision

Many important factors can influence your decision to either pay upfront or use a loan for your steel building project.

Your Financial Situation

Your current financial situation, such as your credit score, credit history, and cash savings, is very important for deciding your loan options.

To assess your financial health, start by checking your credit report for key metrics like your credit score, outstanding debts, and payment history. Tools like Credit Karma or Experian offer free access to your score.

Evaluate your liquidity by determining your cash reserves-calculate how many months of expenses you can cover with liquid assets. Better credit scores increase chances of getting a loan and usually lead to lower interest rates. Conversely, solid cash reserves make you a more attractive borrower, potentially leading to better loan terms with lenders.

Interest Rates, Term Loans and Terms

Interest rates, loan interest and loan terms can vary significantly, affecting your total financial commitment and monthly payments.

For example, with a fixed-rate mortgage at 3.5% for 30 years compared to a variable rate that starts at 2.8% but changes later, the total costs can differ significantly.

A $300,000 loan at a fixed rate would result in about $1,347 monthly payments and roughly $184,000 paid in interest over the loan term.

In contrast, a variable rate could initially save money but might cost more in the long run if rates rise significantly after a few years.

It’s important to look at offers from lenders like Quicken Loans, Bank of America, and Wells Fargo to pick the best choice.

Project Timeline

The timeline of your project can influence your funding choice, especially if quick access to capital or building loans is necessary.

For example, if you start a construction project that depends on the season, you might look for lenders who quickly approve loans. In this scenario, consider short-term loans or lines of credit, allowing you to quickly mobilize resources.

Tools like Fundera let you quickly compare choices. If your project will take a few months and you don’t need money quickly, regular bank loans may offer lower interest rates.

Always assess the potential costs of delays versus the urgency of your needs to determine the optimal funding strategy.

Final Thoughts on Financing Steel Buildings

Knowing your financing options, including down payment and equity investment, can help you make decisions that match your financial goals and project plans.

- Start by exploring traditional financing methods like bank loans, which typically offer lower interest rates but require a solid credit score and collateral.

- Alternatively, consider alternative lenders or peer-to-peer platforms, which may have more flexible requirements but often entail higher costs.

- If you are looking into crowdfunding, platforms like Kickstarter or Indiegogo can help you raise capital while validating your project idea.

- Assess these options by comparing their terms, interest rates, and repayment schedules to determine which best suits your financial situation.

Next Steps for Interested Buyers

For potential buyers, the next steps involve evaluating your financial situation and researching available financing options.

Begin by assessing your current finances: take stock of your credit score, monthly income, and existing debts. After reading this summary, consider funding options like standard bank loans or lenders who focus on steel structures.

For example, you can contact companies like Nationwide Equipment Financing or Bison Financial Group, which provide specific loans for construction purposes.

Consult a financial advisor to identify any local grants or incentives that could further lower your total project costs and operating expenses.

About the Author

Written by Jason Caldwell, a Texas Tech University graduate with a bachelor’s degree in Construction Engineering. As the owner of a successful metal building supply and construction company in Oklahoma for 15 years and a writer and editor for Steel Building Zone, I specialize in helping businesses design and build durable, high-performing metal structures for commercial and industrial use.

Leave a Reply